Individual Income Tax Table 2024. You pay tax as a percentage of your income in layers called tax brackets. See current federal tax brackets and rates based on your income and filing status.

Income tax rate (year 2023 onwards). The federal income tax has seven tax rates in 2024:

Use The Tax Table, Tax Computation Worksheet, Qualified Dividends And Capital Gain Tax Worksheet*, Schedule D Tax Worksheet*, Or Form 8615, Whichever Applies.

The chart shown below outlining the 2023 maryland income tax rates and brackets is for illustrative.

China Residents Income Tax Tables In 2024 Personal Income Tax Rates And Thresholds (Annual) Tax Rate Taxable Income Threshold;

For tax year 2024, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing.

$3,060 Plus 35.5 Cents For Each $1.

Images References :

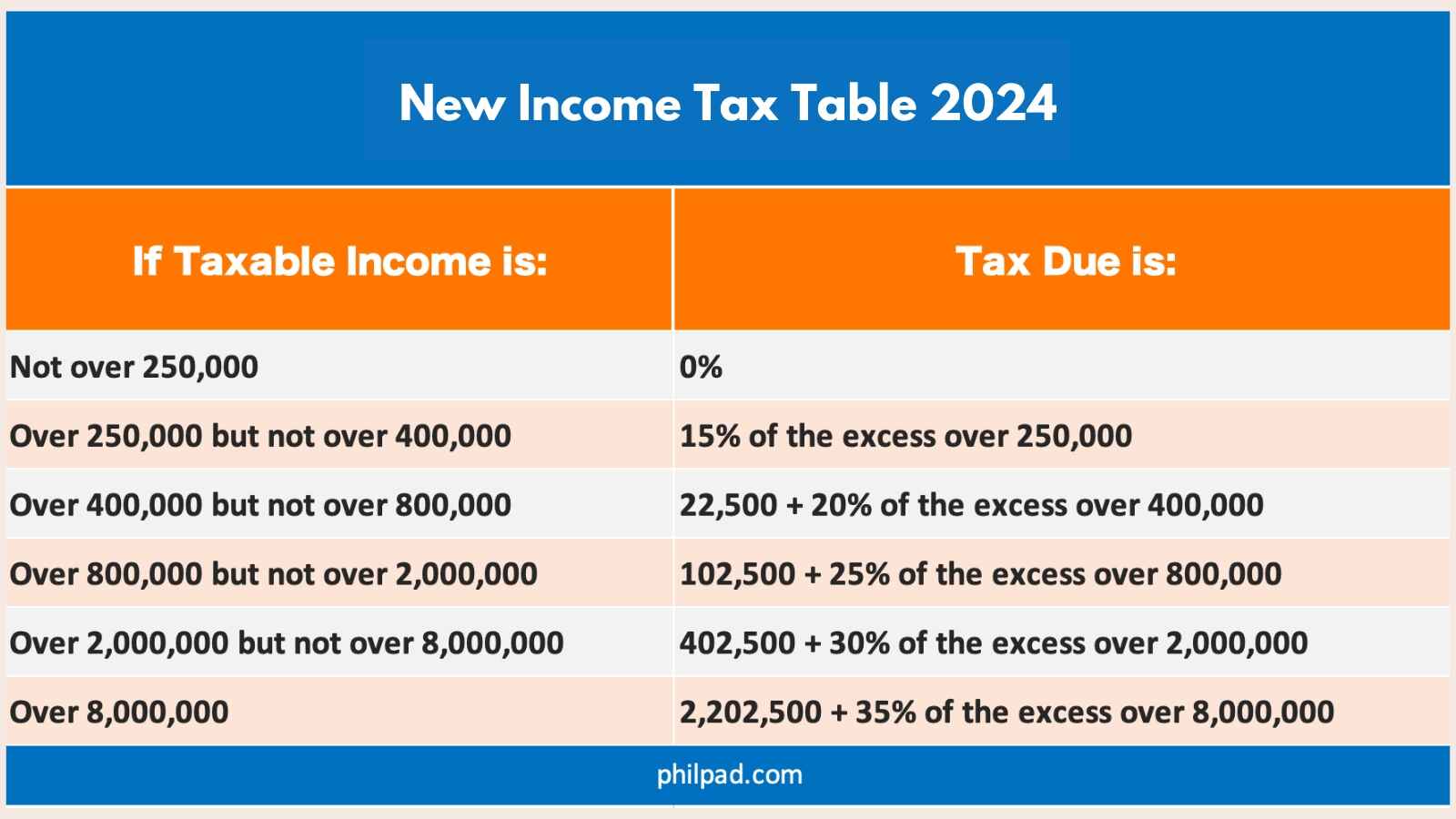

Source: philpad.com

Source: philpad.com

New Tax Table 2024 Philippines (BIR Tax Table), These rates apply to your taxable income. Missouri residents state income tax tables for widower filers in 2024 personal income tax rates and thresholds;

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, These rates apply to your taxable income. Your bracket depends on your taxable income and filing status.

Source: www.fity.club

Source: www.fity.club

Withholding Tax Table, Tax rate taxable income threshold; Use the tax table, tax computation worksheet, qualified dividends and capital gain tax worksheet*, schedule d tax worksheet*, or form 8615, whichever applies.

Source: 2023vjk.blogspot.com

Source: 2023vjk.blogspot.com

10+ Calculate Tax Return 2023 For You 2023 VJK, From 1 july 2024, the. For taxable years beginning in 2024, the north carolina individual income tax rate is 4.5%.

Source: www.jobstreet.com.my

Source: www.jobstreet.com.my

What You Need To Know About Tax Calculation in Malaysia, In 2024, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). 0.618% of ohio taxable income.

Source: printableformsfree.com

Source: printableformsfree.com

2022 Tax Rate Tables Printable Forms Free Online, These changes are now law. For the tax year 2024, the top tax rate is 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing jointly).

Source: apacmonetary.com

Source: apacmonetary.com

How To Compute Tax In The Philippines Free Calculator APAC, Income tax rate (year 2023 onwards). Missouri residents state income tax tables for widower filers in 2024 personal income tax rates and thresholds;

Source: investorinsights360.com

Source: investorinsights360.com

Federal Tax Earnings Brackets For 2023 And 2024 Investor Insights 360, 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37. The federal income tax has seven tax rates in 2024:

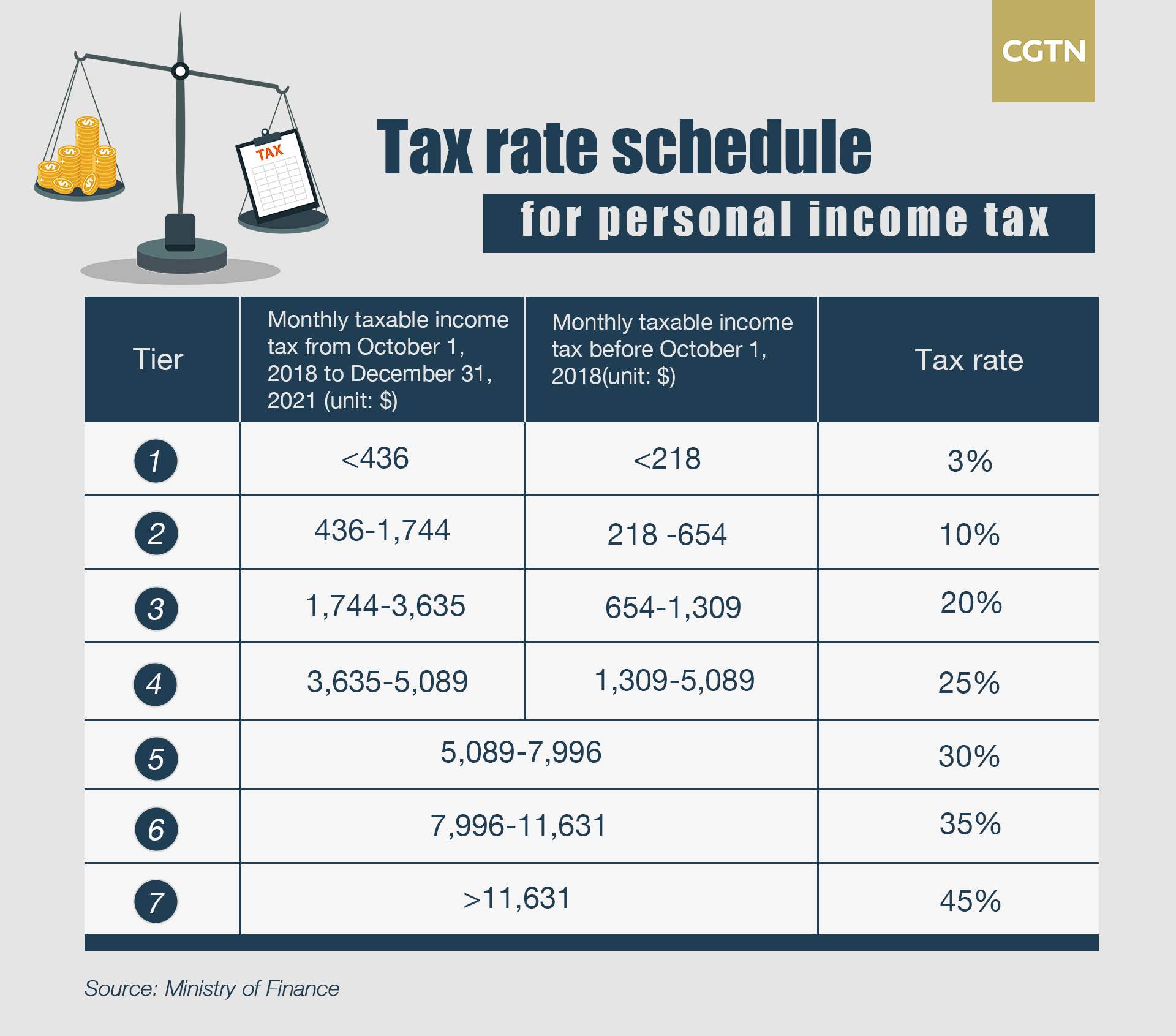

Source: news.cgtn.com

Source: news.cgtn.com

China releases tax rate schedule for yearend bonuses CGTN, Income tax rate (year 2023 onwards). $3,060 plus 35.5 cents for each $1.

Source: brokeasshome.com

Source: brokeasshome.com

Withholding Tax Table 2019, The income tax rates and personal allowances in japan are updated annually with new tax tables published for resident and non. See current federal tax brackets and rates based on your income and filing status.

Maryland Income Tax Rates And Brackets.

For tax year 2024, the top tax rate remains 37% for individual single taxpayers with incomes greater than $609,350 ($731,200 for married couples filing.

You Pay Tax As A Percentage Of Your Income In Layers Called Tax Brackets.

Income tax rate (year 2023 onwards).