Edd 2024 Federal And State Payroll Taxes – Below, you’ll learn what qualifies as payroll tax, how to calculate payroll tax and how to differentiate payroll tax from income tax. Payroll taxes are payouts to federal and state governments and . As you may expect, state taxes can vary. As of 2024 Federal Insurance Contributions Act (FICA) taxes, to the IRS. When employees file their taxes, they do not have to manually input their .

Edd 2024 Federal And State Payroll Taxes

EDD on X: “#Unemployment customers: Access your Form 1099G

Are “extended benefits” still a thing? : r/Edd

California’s unemployment insurance fund has a stubborn

North Valley Employer Advisory Council (NVEAC) Events | Eventbrite

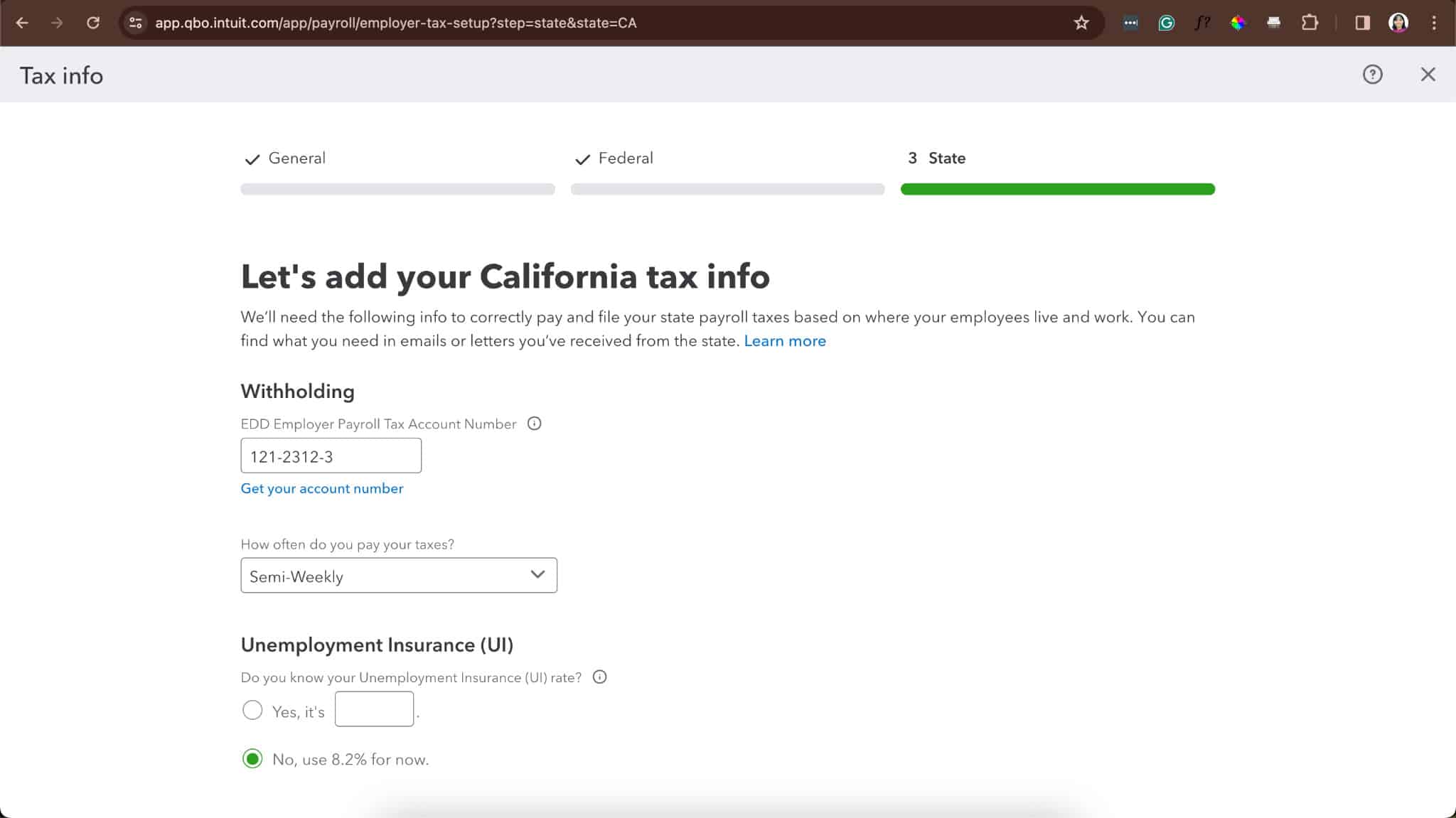

How to Do Payroll on QuickBooks Techopedia

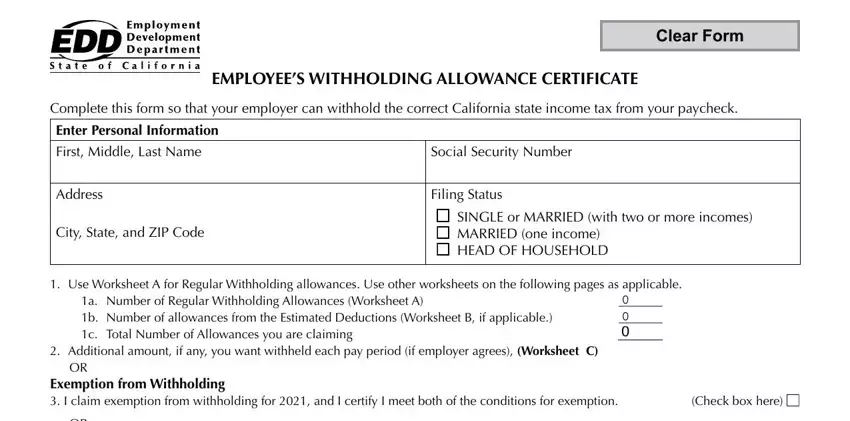

California Form De 4 ≡ Fill Out Printable PDF Forms Online

State of West Virginia

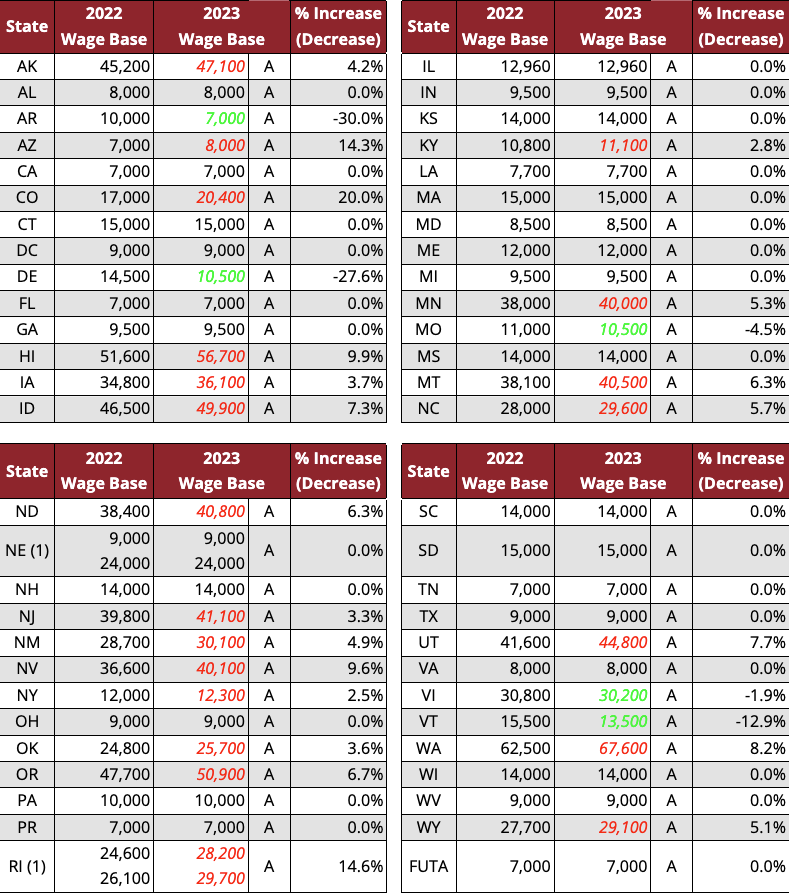

Outlook for SUI Tax Rates in 2023 and Beyond

EDD on X: “Webinar alert! You are invited to attend the no cost

Edd 2024 Federal And State Payroll Taxes Employee’s Withholding Allowance Certificate (DE 4) Rev. 53 (12 23): For both 2023 and 2024, the seven federal income tax rates are 10%, 12%, 22%, 24%, 32%, 35% and 37%. Below, CNBC Select breaks down the updated tax brackets of 2024 and what you need to know. . When it comes to state taxes, a majority of states adhere to the federal government’s timetable, but some have their own schedule. (See more below.) The 2024 tax company’s HR or payroll .

]]> Posted in 2024